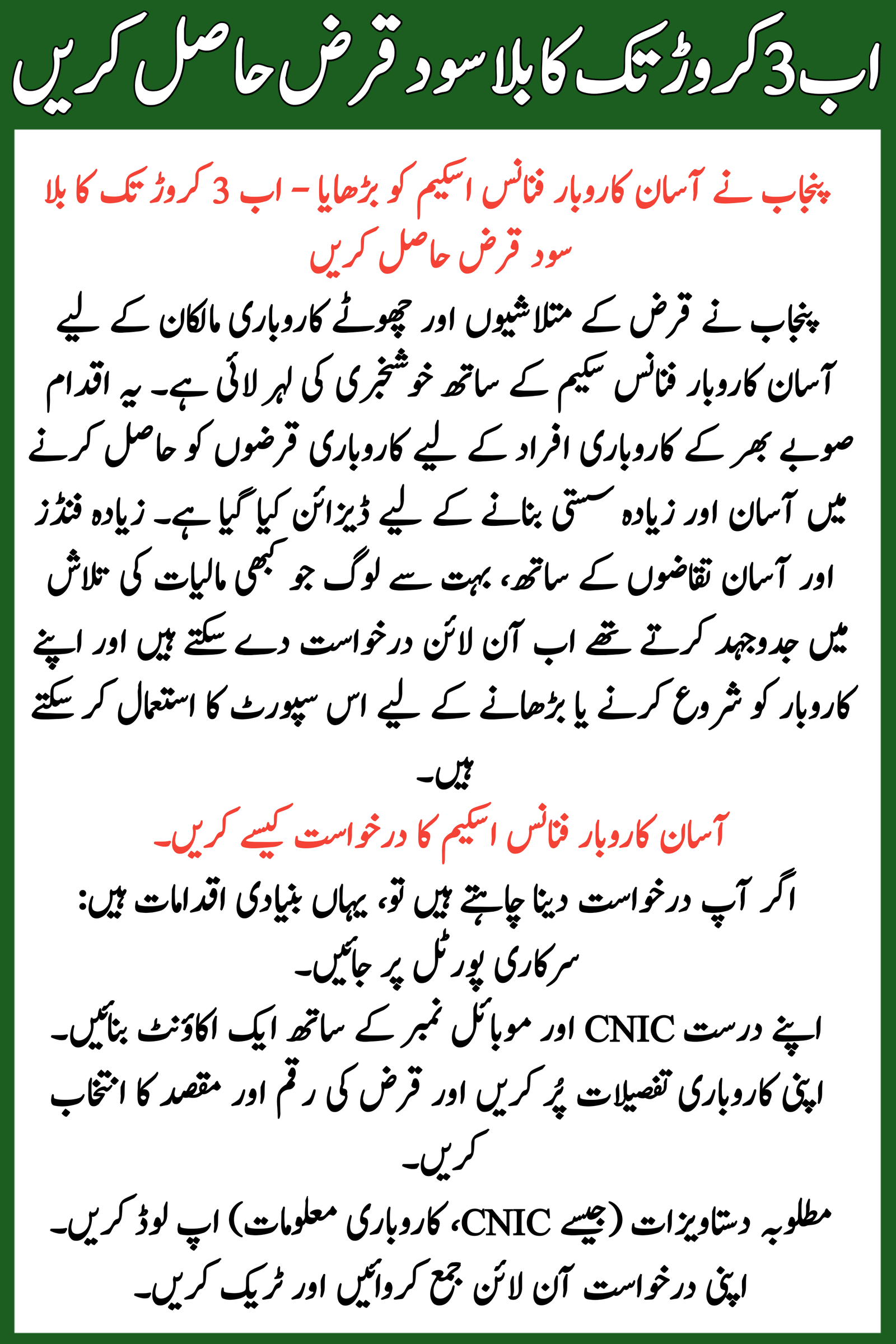

Punjab has brought a wave of good news for loan seekers and small business owners with the Expands Asaan Karobar Finance Scheme. This initiative is designed to make business loans easier to get and more affordable for entrepreneurs across the province. With more funds and simpler requirements, many people who once struggled to find finance can now apply online and use this support to start or grow their business.

Read More: Parwaz Card Registration New Rules

Table of Contents

What Is the Asaan Karobar Finance Scheme?

The Asaan Karobar Finance Scheme is a government-backed business financing program run by the Government of Punjab in partnership with the Bank of Punjab. Its main aim is to help small and medium enterprises (SMEs), new startups, and business owners get loans without heavy interest or complicated conditions. This makes it easier for more people to access money and take their business ideas forward.

Key Asaan Karobar Finance Scheme Details

| Feature | Details |

| Loan Amount | Up to PKR 30 million (3 crore) |

| Interest Rate | 0% (interest-free) |

| Loan Tenure | Up to 5 years |

| Grace Period | 3–6 months before repayment starts |

| Processing Fee | From PKR 5,000 to PKR 10,000 |

| How to Apply | Online through official portal or helpline 1786 |

Loans are available for many business needs like starting a new venture, expanding an existing one, buying equipment, and more. The interest-free setup means you don’t have to pay extra money on top of what you borrow, making it friendly for people who are just starting out.

Read More: Breaking Weather Update

Asaan Karobar Card – Easier Short-Term Finance

Along with the main loan scheme, the Asaan Karobar Card helps small entrepreneurs with short-term financial needs. This card acts like a revolving credit limit that you can use for everyday business expenses like inventory, bills, or cash flow requirements.

| Card Feature | Details |

| Maximum Credit Limit | Up to PKR 1 million |

| Interest Rate | 0% interest |

| Best For | Operational costs, working capital |

| Repayment Term | Up to 3 years |

| Usage | Digital payments, POS, business needs |

Why This Expands Asaan Karobar Finance Scheme Matters

Punjab’s government has boosted this scheme so that more people can benefit from accessible business loans. Earlier, many small business owners faced difficulties due to high interest rates and strict bank conditions. Now, with loans up to PKR 30 million and the option to start with as little as PKR 1 million through the Karobar Card, business owners have real chances to succeed. This also supports job creation and overall economic growth in the province. Another big plus is the easy online application process. You don’t need to visit many offices or deal with piles of paperwork. Many steps can be completed from home, and applicants can check their status online or through the helpline 1786.

Read More: Gold Rate in Pakistan

How to Apply Asaan Karobar Finance Scheme

If you want to apply, here are the basic steps:

- Visit the official portal.

- Create an account with your valid CNIC and mobile number.

- Fill in your business details and choose the loan amount and purpose.

- Upload required documents (like CNIC, business info).

- Submit and track your application online.

Final Thought

This expansion of the Asaan Karobar Finance Scheme is a step forward for entrepreneurs in Punjab. If you’ve been waiting for an easier way to fund your business, now is a great time to explore this opportunity. Apply online today and take a step closer to growing your business dream without worrying about heavy interest or long red tape.

Read More: Parwaz Card Required Documents

FAQs

Q: Who can apply for the Asaan Karobar Finance Scheme?

Residents of Punjab with a valid CNIC, clean credit history, and business plans are eligible. Age criteria and tax filing status may apply.

Q: Is the loan really interest-free?

Yes. The scheme offers business loans with 0% interest, meaning no extra cost on top of the loan amount.

Q: Can I use the loan for expanding my existing business?

Absolutely. The scheme supports startups as well as existing businesses that want to expand or modernize.

Q: How long do I have to repay the loan?

Depending on the loan type, you can get up to 5 years to repay with easy monthly installments.

Q: What is the Asaan Karobar Card used for?

This card is best for short-term needs like buying inventory or paying operational costs. It provides interest-free credit up to PKR 1 million.

This article is for informational purposes only. SmartFixers.pk is not an official government website and is not affiliated with any government department. Readers are advised to verify all information from official government sources before taking any action.

Our editorial team publishes original and informational content for educational purposes only.

Related Posts