The PM Youth Business and Agriculture Loan Scheme 2026 is a government program to help young Pakistanis start their own businesses or modern farms. The main aim is to make youth job creators instead of job seekers. The scheme provides interest-free and subsidized loans, with special support for digital businesses and women entrepreneurs. The application process is fully online, making it easy and fast.

| Feature | Details |

|---|---|

| Purpose | Support youth entrepreneurship and modern farming |

| Loan Tiers | Tier 1, Tier 2, Tier 3 |

| Loan Amount | Rs. 500,000 – Rs. 30 Million |

| Interest Rate | 0%, 5%, 7% depending on tier |

| Age Limit | 21–45 (IT/E-commerce: 18+) |

| Eligibility | Pakistani citizens with clean credit history |

| Quota | 25% reserved for women and digital businesses |

| Application | 100% online via pmyp.gov.pk |

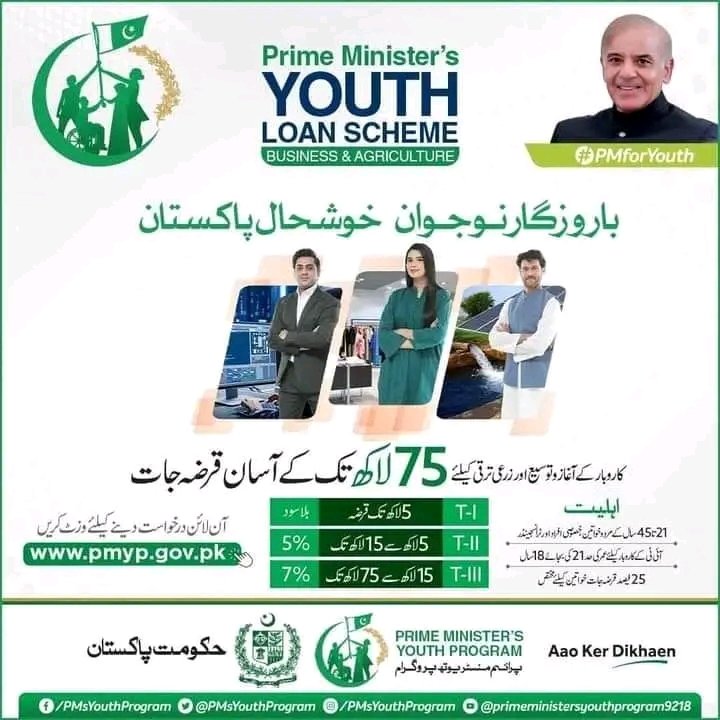

Loan Tiers and Interest Rates

The scheme divides loans into three tiers, based on the amount and type of business.

- Tier 1: Up to Rs. 500,000 with 0% interest, repayable in 3 years

- Tier 2: Rs. 500,000 to 1.5 million with 5% interest, repayable in 8 years

- Tier 3: Rs. 1.5 million to 10 million (or 30 million for special projects) with 7% interest, repayable in 8 years

Choosing the Right Tier:

- Tier 1 is best for small startups

- Tier 2 works for growing businesses

- Tier 3 suits large projects or modern agriculture

PM Youth Loan – Key Details Table

| Tier | Loan Amount | Interest | Repayment Period | Purpose | Quota | Eligibility | Benefits |

|---|---|---|---|---|---|---|---|

| T1 | Up to 500,000 | 0% | Up to 3 years | Small startups | Women & digital businesses | Age 21–45 | Interest-free, quick approval |

| T2 | 500,000–1.5M | 5% | Up to 8 years | Business expansion | Women & digital businesses | Age 21–45 | Subsidized interest, flexible repayment |

| T3 | 1.5M–10M | 7% | Up to 8 years | Large projects | Women & digital businesses | Age 21–45 | High capital support, long-term growth |

| Special | Up to 30M | 7% | Up to 8 years | Special agriculture & tech projects | Women & digital businesses | Age 21–45 | Extra funding for special initiatives |

Who Can Apply for PM Youth Loans

Eligibility rules ensure the right candidates get support.

- Applicants must be Pakistani citizens

- Age limit is 21–45 years (IT/E-commerce: 18+)

- Must have clean credit history, no defaulters

- Education: Minimum Matric for business; agriculture experience accepted

- Eligible sectors: Agriculture, IT, Services, Manufacturing, Retail

- Dual nationals cannot apply

How to Apply Online for PM Youth Loan

The application is fully online and free. No agent fees are required.

Step-by-Step Process:

- Visit the official portal: pmyp.gov.pk

- Verify CNIC number and date of issue

- Select the loan tier according to your needs

- Fill personal and business details

- Upload documents: CNIC, photo, business plan, educational certificates

- Save tracking number to check status

Required Documents for PM Youth Loan

Before applying, prepare all necessary documents to avoid delays.

- CNIC (front and back)

- Recent passport-size photo

- Complete business plan with projected costs

- Educational certificates (minimum Matric)

- References: Two people with CNICs to verify credibility

Participating Banks:

- National Bank of Pakistan (NBP)

- Bank of Punjab (BOP)

- Habib Bank Limited (HBL)

- United Bank Limited (UBL)

- More than 15 other banks

Benefits of PM Youth Business and Agriculture Loan

The scheme offers financial support with flexible repayment options to help youth succeed.

- Interest-free loans for small startups

- Subsidized loans for larger projects

- 25% quota for women and digital businesses

- Repayment period from 3–8 years

- Support for modern agriculture, IT, and service businesses

A strong business plan and complete documentation improve the chances of approval.

Conclusion

The PM Youth Business and Agriculture Loan 2026 is an excellent opportunity for young Pakistanis to start businesses or farms with government support. Interest-free and subsidized loans, online application, and bank participation make it simple to get funding. Proper planning, choosing the right loan tier, and ready documents are key to success.

FAQS:

Q1: Who is eligible for PM Youth Loan 2026?

A: Pakistani citizens aged 21–45 (IT/E-commerce: 18+), with a clean credit history and minimum education Matric for business.

Q2: How much loan can I get under this scheme?

A: Loans range from Rs. 500,000 (Tier 1) to Rs. 10 million (Tier 3). Special projects can receive up to Rs. 30 million.

Q3: Are Tier 1 loans interest-free?

A: Yes, Tier 1 loans have 0% interest. Tier 2 and Tier 3 have subsidized interest of 5% and 7%.

Q4: Where can I apply online for PM Youth Loan?

A: Applications are submitted online at pmyp.gov.pk.

This article is for informational purposes only. SmartFixers.pk is not an official government website and is not affiliated with any government department. Readers are advised to verify all information from official government sources before taking any action.

Our editorial team publishes original and informational content for educational purposes only.

Related Posts