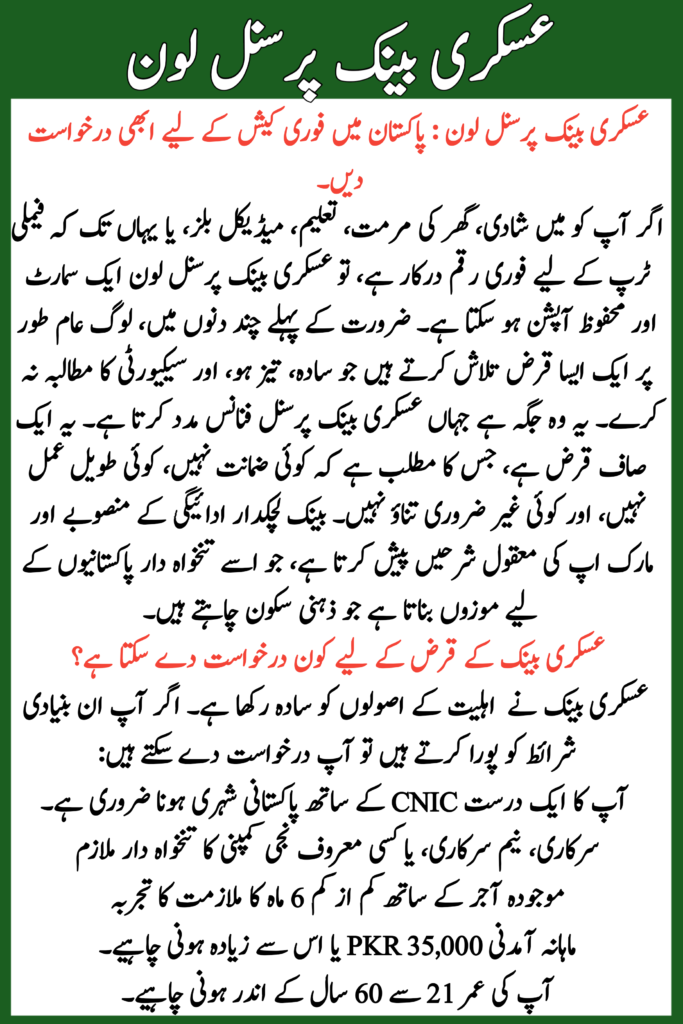

If you need quick money in 2026 for a wedding, home repair, education, medical bills, or even a family trip, Askari Bank Personal Loan 2026 can be a smart and safe option. In the first few days of need, people usually look for a loan that is simple, fast, and does not demand security. This is where Askari Bank Personal Finance helps. It is a clean loan, meaning no collateral, no long process, and no unnecessary stress. The bank offers flexible repayment plans and reasonable markup rates, making it suitable for salaried Pakistanis who want peace of mind.

Read More: Punjab Kisan Card Registration Status

Table of Contents

Askari Bank Personal Loan 2026

| Feature | Details for 2026 |

| Loan Amount | PKR 50,000 to PKR 4,000,000 |

| Tenure | 1 Year to 4 Years |

| Processing Time | Approximately 10 Working Days |

| Markup Type | Fixed & Variable Options |

| Minimum Income | PKR 35,000 (Salaried) |

| Age Limit | 21 to 60 Years |

| No Security | Clean/Unsecured Facility |

| Repayment | Equal Monthly Installments (EMI) |

Who Can Apply for an Askari Bank Loan?

Askari Bank has kept the eligibility rules simple in 2026. You can apply if you meet these basic conditions:

- You must be a Pakistani citizen with a valid CNIC

- Salaried employee of government, semi-government, or a reputable private company

- Minimum 6 months job experience with current employer

- Monthly income should be PKR 35,000 or above

- Your age should fall within 21 to 60 years

Meeting these points increases your approval chances and speeds up the process.

Read More: Apni Chhat Apna Ghar Scheme Application Status

Why People Prefer Askari Personal Loan in 2026

Many borrowers choose Askari Bank because of its customer-friendly features. Here is why it stands out:

- No security or guarantor required

- Loan amount up to PKR 4 million

- Easy monthly installments

- Option to transfer loan from another bank

- Top-up facility after regular payments

- Transparent charges with no surprises

For people already managing expenses, this flexibility really matters.

Askari Loan Documents Required for Fast Approval

Before applying, keep your documents ready to avoid delays:

- Copy of valid CNIC

- Latest salary slip

- Last 6 months bank statement

- Employment certificate

- Filled loan application form

Having complete documents often means quicker approval.

Read More: Himmat Card Punjab Balance

Apply for Askari Personal Loan

| Step | What You Need to Do |

| Step 1 | Check eligibility on Askari Bank website |

| Step 2 | Submit online inquiry or visit branch |

| Step 3 | Receive call from bank representative |

| Step 4 | Submit documents |

| Step 5 | Verification & credit check |

| Step 6 | Approval and amount credited |

Charges You Should Know About

Like all banks, Askari also has standard charges:

- Processing fee (usually around 1–1.5%)

- Late payment charges if EMI is delayed

- Early settlement charges (if applicable)

- Loan insurance as per bank policy

Always ask for the Schedule of Charges before signing.

Askari Bank Helpline & Contact Details

If you have any specific questions or need assistance with your application, you can reach out to the bank directly through the following official channels:

- 24/7 Helpline: (051) 111-000-787

- Email Support: customerservices@askaribank.com.pk

- WhatsApp Banking: +92 51 111 000 787

- Head Office: NPT Building, F-8 Markaz, Islamabad, Pakistan.

Final Thoughts

The Askari Bank Personal Loan 2026 is a reliable choice for salaried individuals who want quick cash without long paperwork. With flexible tenure, reasonable markup, and a trusted banking name, it offers both comfort and control. Still, always borrow responsibly and choose an EMI that fits your monthly budget.

Read More: SNGPL Online Bill Check

FAQs

Q: How long does Askari Bank take to approve a personal loan?

Usually 7 to 10 working days after complete documents submission.

Q: Can I apply without an Askari Bank account?

Yes, but you will need to open an account for loan disbursement.

Q: What is the maximum loan amount in 2026?

Up to PKR 4,000,000, depending on income and repayment capacity.

Q: Is Askari Bank personal loan Islamic?

This personal loan is conventional and based on markup.

This article is for informational purposes only. SmartFixers.pk is not an official government website and is not affiliated with any government department. Readers are advised to verify all information from official government sources before taking any action.

Our editorial team publishes original and informational content for educational purposes only.

Related Posts