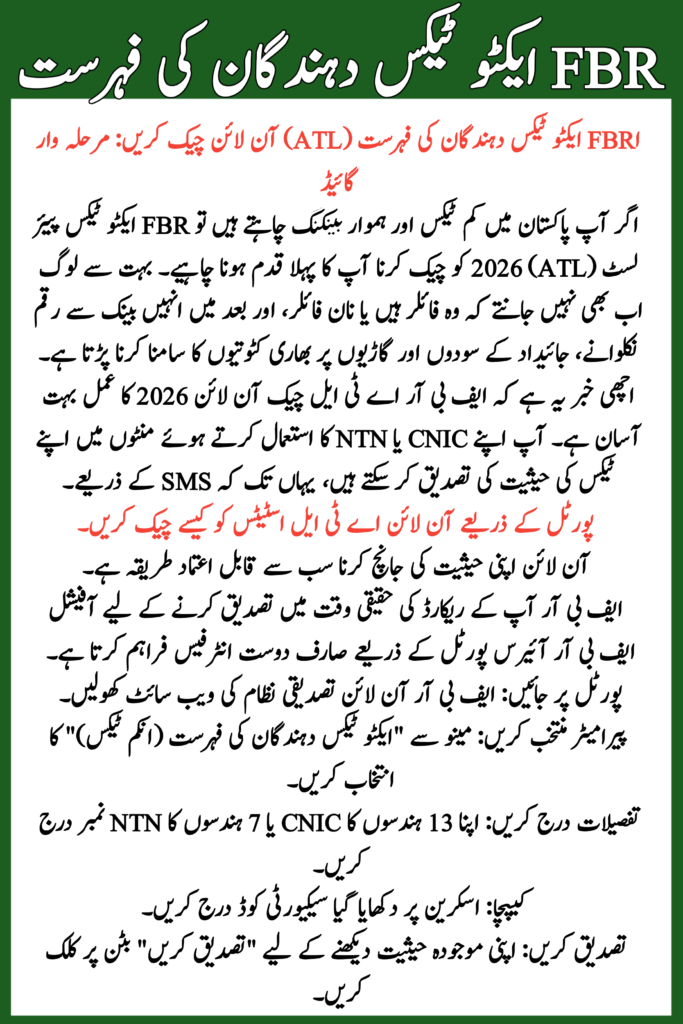

If you want lower taxes and smooth banking in Pakistan, checking the FBR Active Taxpayer List (ATL) 2026 should be your first step. Many people still don’t know whether they are filer or non-filer, and later face heavy deductions on bank withdrawals, property deals, and vehicles. The good news is that the FBR ATL check online 2026 process is very simple. You can verify your tax status within minutes using your CNIC or NTN, even through SMS.

This guide explains everything in clear, simple words, just like a normal human-written article, so anyone can understand it easily.

Read More: Punjab Kisan Card Registration Status

Table of Contents

FBR Active Taxpayer List (ATL) 2026

| Feature | Details for 2026 |

| Main Authority | Federal Board of Revenue (FBR) |

| List Name | Active Taxpayer List (ATL) |

| Update Frequency | Every Monday |

| Check Method 1 | FBR Official Web Portal |

| Check Method 2 | SMS Service (9966) |

| Surcharge for Individuals | PKR 1,000 |

| Surcharge for Companies | PKR 20,000 |

| Official Website | https://www.fbr.gov.pk |

Importance of FBR Active Taxpayer List 2026

The Active Taxpayer List (ATL) is an official list issued by the Federal Board of Revenue (FBR). It shows the names of people and businesses who have filed their income tax return and are considered active taxpayers.

If your name appears on the ATL, you are treated as a filer. If not, you are marked as a non-filer, which means higher tax rates almost everywhere.

Read More: Apni Chhat Apna Ghar Scheme Application Status

How to Check ATL Status Online via Portal

Checking your status online is the most reliable method. The FBR provides a user-friendly interface through theOfficial FBR Iris Portal to verify your records in real-time.

- Visit Portal: Open the FBR Online Verification System website.

- Select Parameter: Choose “Active Taxpayer List (Income Tax)” from the menu.

- Enter Details: Input your 13-digit CNIC or 7-digit NTN number.

- Captcha: Enter the security code shown on the screen.

- Verify: Click the “Verify” button to see your current status.

Check Your FBR Status via SMS (Quick Method)

If you do not have internet access, you can use the SMS service. This is a quick way to confirm if you are a “Filer” or “Non-Filer” using your mobile phone.

- Format: Type “ATL” followed by a space and your 13-digit CNIC number.

- Recipient: Send this message to the official shortcode 9966.

- AJK Status: For AJK taxpayers, type “AJKATL” and send to 9966.

- Business Check: Companies can use their NTN instead of CNIC in the same format.

Read More: Himmat Card Punjab Balance

How to Become Active on ATL in 2026

If your name is not on the list, don’t worry. You can fix it.

What You Need to Do:

- Register for NTN if not registered

- File your Income Tax Return 2025–26

- Pay ATL surcharge (if late)

- Wait for the next Monday update

Once done, your name will appear on the ATL automatically.

FBR Helpline & Contact Details

If you encounter issues while checking your status or filing your returns, the FBR offers dedicated support lines.

- National Helpline: 051-111-772-772

- Email Support: helpline@fbr.gov.pk

- Timing: 08:30 AM to 11:30 PM (Monday to Friday)

- Female Support Line: 051-9107025

Conclusion

The FBR Active Taxpayer List (ATL) 2026 is the official benchmark for tax compliance in Pakistan. By following the steps mentioned above, you can easily verify your status and ensure you are not overpaying on essential services. Remember, the list is updated every Monday, so if you have recently filed your return or paid a surcharge, check back after the next update. Staying active is not just a duty but a smart financial move.

Read More: SNGPL Online Bill Check

FAQs

How often is the FBR ATL updated?

The Active Taxpayer List is updated every Monday by the Federal Board of Revenue to include new filers.

What is the penalty for late filing in 2026?

Individuals must pay a surcharge of PKR 1,000, while companies must pay PKR 20,000 to appear on the ATL after the deadline.

Can I check my status without an NTN?

Yes, you can use your 13-digit CNIC number to check your status through the online portal or the SMS service.

Why is my status showing as ‘Inactive’ after filing?

If you filed after the due date, your status will remain ‘Inactive’ until you pay the ATL surcharge through a PSID.

This article is for informational purposes only. SmartFixers.pk is not an official government website and is not affiliated with any government department. Readers are advised to verify all information from official government sources before taking any action.

Our editorial team publishes original and informational content for educational purposes only.

Related Posts