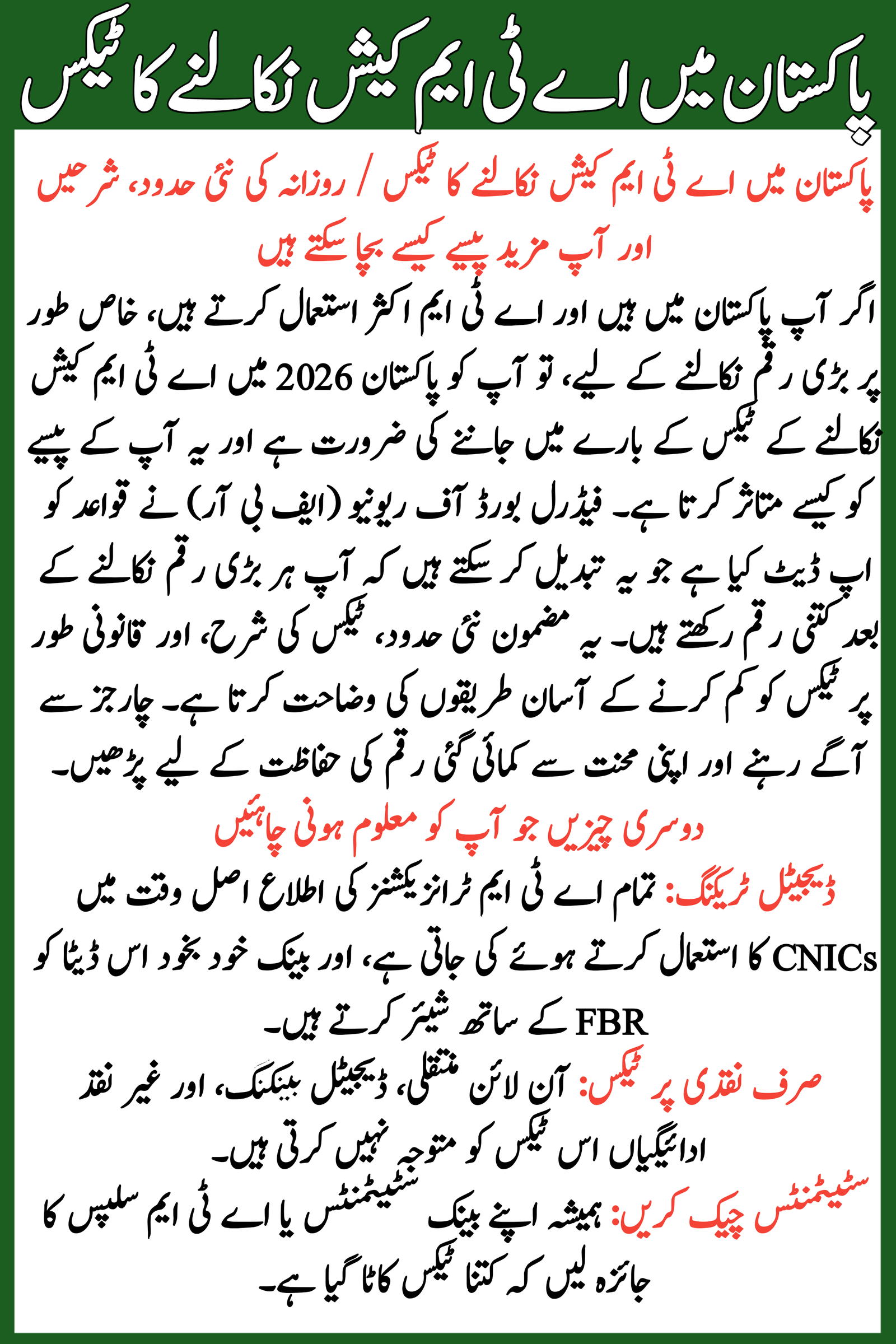

If you’re in Pakistan and use ATMs often, especially for big withdrawals, you need to know about the ATM cash withdrawal tax in Pakistan 2026 and how it affects your money. The Federal Board of Revenue (FBR) has updated rules that can change how much cash you keep after every big withdrawal. This article explains the new limits, tax rates, and simple ways to lower the tax legally. Read on to stay ahead of charges and protect your hard-earned cash.

Table of Contents

What Is ATM Cash Withdrawal Tax in Pakistan?

The ATM cash withdrawal tax is a tax FBR charges automatically when you take out cash from your bank account using an ATM. It applies only if your total cash withdrawal in a single day goes above a set limit. Banks deduct this tax right away — you don’t have to pay it manually.

The main goal of this system is to encourage digital payments, reduce cash abuse, and bring more people into the tax system. It also helps the government track big cash movements better.

Read More: Parwaz Card Registration New Rules

Latest 2026 ATM Tax Rates & Limits in Pakistan

| Account Holder | Daily Limit (PKR) | Tax Rate |

| Filer | Above 50,000 | 0.3% on amount above limit |

| Non-Filer | Above 75,000 | 1.2% on amount above limit |

| Small Withdrawals | Below limits | 0% (No tax) |

Important Note: Filers pay much less tax than non-filers. Non-filers face higher charges once they cross the daily exemption.

Why These Rules Matter to You

Before 2026, some older rules taxed cash withdrawals differently, such as non-filers paying 0.8% on amounts over Rs. 50,000 per day. Recent changes now raise limits and adjust rates, meaning non-filers can withdraw a bit more before tax applies, but the tax rate itself is higher. These rules apply whether you use an ATM or get cash over the bank counter, and the tax is taken automatically by banks. It won’t show up as a separate notice — but it will reduce the amount you get in hand.

Read More: Breaking Weather Update

Smart Ways to Pay Less Tax

| Strategy | Why It Helps |

| Become an Active Filer | You pay much less tax (0.3%) on withdrawals above the limit. |

| Use Digital Payments | Transfers, QR codes, wallet payments are tax-free. |

| Split Large Withdrawals | Take cash on different days to stay under limits. |

| Reduce Cash Use | Rely more on banking apps, cards, or wallets. |

Other Things You Should Know

- Digital tracking: All ATM transactions are reported in real time using CNICs, and banks automatically share this data with FBR.

- Tax only on cash: Online transfers, digital banking, and non-cash payments don’t attract this tax.

- Check statements: Always review your bank statements or ATM slips to see how much tax was deducted.

Read More: Gold Rate in Pakistan

FAQs

Q: What counts as a daily withdrawal?

All cash taken out from ATMs and over-the-counter withdrawals from the same account in one day add up.

Q: Can filers avoid this tax completely?

If you stay under the daily limit, yes. But once you go above it, you’ll pay a lower tax rate compared to non-filers.

Q: Do other bank services charge this tax?

No. This tax applies only to cash you withdraw. Transfers or digital purchases remain tax-free.

Q: Is this tax refundable?

Filers can sometimes adjust the deducted amount in their annual tax returns.

This article is for informational purposes only. SmartFixers.pk is not an official government website and is not affiliated with any government department. Readers are advised to verify all information from official government sources before taking any action.

Our editorial team publishes original and informational content for educational purposes only.

Related Posts