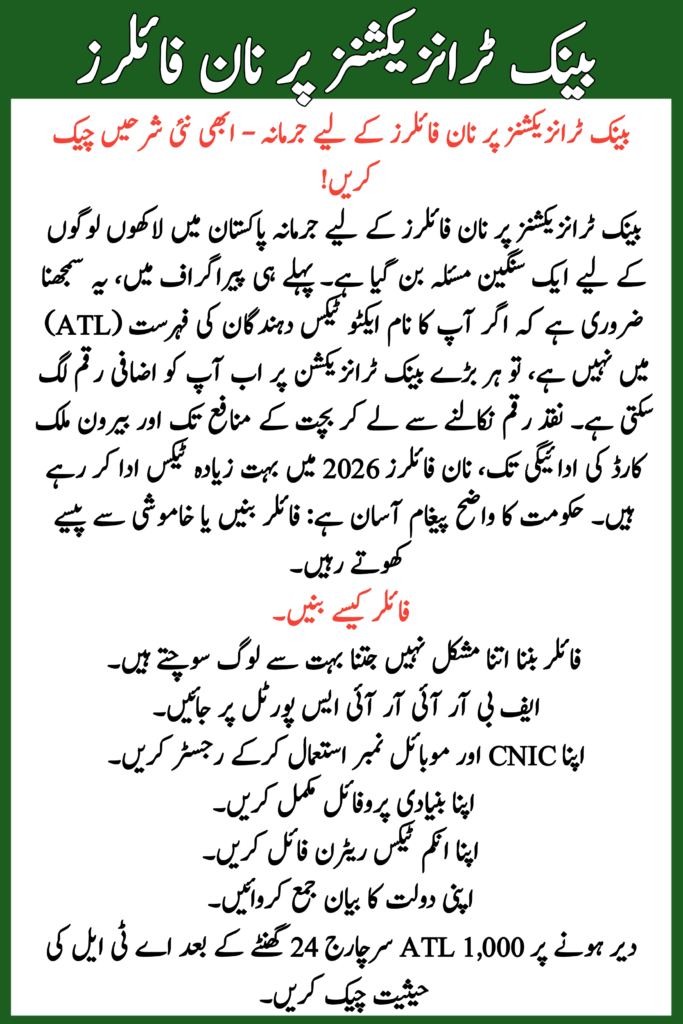

The Penalty for Non-Filers on Bank Transactions 2026 has become a serious issue for millions of people in Pakistan. It is important to understand that if your name is not on the Active Taxpayers List (ATL), every major bank transaction can now cost you extra money. From cash withdrawals to savings profit and even card payments abroad, non-filers are paying much higher taxes in 2026. The government’s clear message is simple: become a filer or keep losing money silently.

Pakistan’s tax authorities want more people to enter the documented economy. That is why new rules are stricter, clearer, and more expensive for those who avoid filing returns. Many people only realize the impact when they see heavy deductions in their bank statements.

Read More: Punjab Kisan Card Registration Status

Table of Contents

| Transaction Type | Filer Rate | Non-Filer Rate (Penalty) |

| Cash Withdrawal (Above 50k) | 0% | 0.8% – 1% |

| Profit on Debt (Savings) | 15% | 35% – 40% |

| International Card Payments | 1% – 5% | 2% – 10% |

| Motor Vehicle Registration | Lower | 200% Higher |

| Property Purchase | 3% | 10% – 15% |

| Prize Bond Winnings | 15% | 30% |

| Dividend Income | 15% | 30% |

| Annual Surcharge for ATL | Rs. 0 | Rs. 1,000 (Individual) |

What Is the Penalty for Non-Filers on Bank Transactions 2026?

The penalty is actually a higher withholding tax deducted directly by banks. If you are not on the ATL, the bank deducts tax and sends it to FBR instantly. For filers, this tax is adjustable or refundable. For non-filers, it is mostly a loss.

For example, if you withdraw large amounts of cash regularly, even a small percentage adds up to thousands of rupees every month. The same applies to profit earned on savings accounts, which is now heavily taxed for non-filers.

Read More: Apni Chhat Apna Ghar Scheme Application Status

Latest Cash Withdrawal & Profit Tax Rates

| Category | Old Rate (Non-Filer) | New Rate 2026 |

| Cash Withdrawal Tax | 0.6% | Up to 1% |

| Profit on Debt | 30% | Up to 40% |

| Property Purchase Tax | 7% | 10% – 15% |

| Vehicle Registration | Normal | Almost Double |

These changes have pushed many people to finally register with FBR.

How to Become a Filer in 2026

Becoming a filer is not as difficult as many people think.

- Visit the FBR IRIS portal

- Register using your CNIC and mobile number

- Complete your basic profile

- File your income tax return

- Submit your wealth statement

- Pay Rs. 1,000 ATL surcharge if late

- Check ATL status after 24 hours

Once active, your tax rates automatically reduce.

Major Problems Faced by Non-Filers

In 2026, non-filers face more than just bank deductions.

- Higher tax on buying cars and property

- Expensive foreign travel through cards

- Difficulty in business deals and tenders

- Risk of account restrictions in serious cases

Life becomes unnecessarily complicated.

Read More: Himmat Card Punjab Balance

Why You Should Move to the Active Taxpayer List

The benefits of becoming a filer far outweigh the effort of filing a return. As an active taxpayer, you enjoy:

- Half Tax Rates: You pay 50% less withholding tax on almost all financial transactions.

- Refund Claims: You can claim a refund for the tax deducted on your electricity bills or phone top-ups.

- Easy Documentation: Having a tax history makes it easier to get visas for the US, UK, or Europe.

- Legal Peace of Mind: You avoid notices from the FBR and the risk of your bank accounts being frozen.

Official Helpline & Contact Information

If you face issues with your tax filing or have questions about the Penalty for Non-Filers on Bank Transactions 2026, you can contact the authorities directly:

- FBR Helpline: 051-111-772-772 (Available 24/7)

- International Callers: +92 51 111 772 772

- Email Support: helpline@fbr.gov.pk

- Official Website: www.fbr.gov.pk

- Head Office: FBR House, Constitution Avenue, G-5, Islamabad.

Final Words

The Penalty for Non-Filers on Bank Transactions 2026 is no longer something you can ignore. Every bank visit, withdrawal, or profit credit reminds you of the cost of staying outside the system. Filing your return once a year can save you a lot of money and stress. In today’s Pakistan, being a filer is not a luxury—it is a smart financial decision.

Read More: SNGPL Online Bill Check

FAQs

What is the cash withdrawal tax for non-filers in 2026?

It is around 0.8% to 1% on daily withdrawals above Rs. 50,000.

Is bank profit tax refundable for filers?

Yes, filers can adjust or claim a refund when filing their return.

Can non-filers buy property in 2026?

Yes, but they pay much higher tax compared to filers.

How long does it take to become active on ATL?

Usually 24 hours after successful return filing.

This article is for informational purposes only. SmartFixers.pk is not an official government website and is not affiliated with any government department. Readers are advised to verify all information from official government sources before taking any action.

Our editorial team publishes original and informational content for educational purposes only.

Related Posts